As their trip comes to its conclusion, our Director of International Programs, Luis Bourdet, and our International Programs Specialist, Yefiny Mena, visit our last affiliated site in Guatemala before traveling to El Salvador, where students enjoy a more structured environment than other schools in Guatemala offer. Today, we hear from Yefiny about the Bethel School and her impression of how it is helping our sponsored children and their families.

“According to our coordinator, it is certain that these children would not have the opportunity to attend a private school like Bethel without our sponsors’ contribution.”

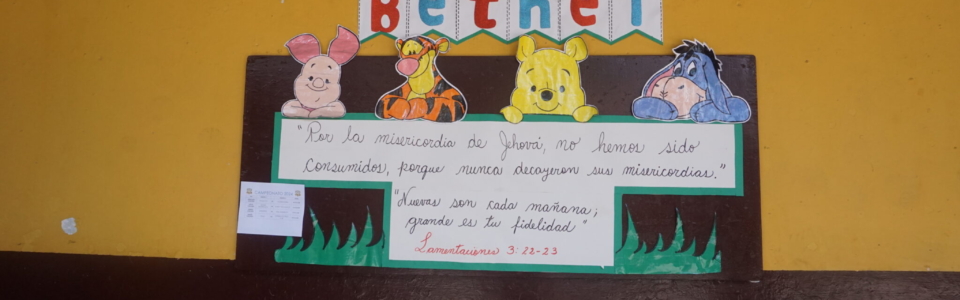

Visiting the Bethel School

“This small private school is located in Quetzaltenango, about 140 miles from Guatemala City, but a good four hours driving due to road conditions and traffic. The Bethel School opened its doors to children in 1956, and fourteen years later, in 1960, Children Incorporated started sponsoring children at this affiliation. The school serves about 300 students, from kindergarten to 12th grade, in two shifts during the day,” said Yefiny.

“Kindergarten comes in the morning, and the 10th, 11th, and 12th grades come in the afternoon. They provide high school classes and technical training in Computer Technology and Accounting. Children Incorporated support is offered to the children of low-income families and covers school fees, other school support, and sometimes clothes and food.”

“The school adheres to the national curriculum to teach the students and provide a good education for participating children. The buildings are in great need of improvements, and the recent pandemic has the school struggling to draw paid students to increase opportunities for children. Overall, the school is a better option than attending local public schools, which are greatly overcrowded and disorganized. The children here have great pride in attending a private school while not spending a great deal to pay for better education, which benefits our Children Incorporated participants,” explained Yefiny.

“Bethel School’s coordinator is Mrs. Maria Josefina Calderon de Singueza, who is the owner and director of the school. Mrs. Calderon has been our coordinator for 56 years. She is also assisted by Katy Singueza, her daughter, who helps her run the program,” she said.

“During our visit to the school, we met the children in their classrooms and interacted with them and their teachers. We also had the opportunity to talk with Mrs. Calderon about the program. Mrs. Calderon explained that most of the children in our program live in areas that were not very safe for us to visit, but we could meet them in the classrooms.”

“According to our coordinator, it is certain that these children would not have the opportunity to attend a private school like Bethel without our sponsors’ contribution. Our monthly subsidies help them pay, in some cases, 75% of the school fees, depending on the child’s school grade. The higher the child’s grade, the more expensive it becomes, but it is still an affordable fee for the children’s parents,” said Yefiny.

“Besides the monthly fee, some children might receive help with school supplies, shoes, or uniforms. This is occasionally done if, for example, one or both parents lose their jobs and face financial difficulties to provide for the child’s needs at school.”

***

How do I sponsor a child with Children Incorporated?

You can sponsor a child in one of three ways: call our office at 1-800-538-5381 and speak with one of our staff members; email us at sponsorship@children-inc.org; or go online to our sponsorship portal, create an account, and search for a child in that is available for sponsorship.

Magda Kegley, a longtime employee of Children Incorporated, passed away quite suddenly on Saturday, March 8th, 2025. During her tenure with Children Incorporated, Magda served in various capacities, including over two decades as Director of our International Division. Many of our coordinators and sponsors became quite familiar with Magda and grew to love her, just as our staff did. She was a ray of sunshine, always smiling and always caring about others. Magda’s kind words touched many hearts, and her laughter challenged us all to find joy in life. Our staff will certainly miss our dear friend. Our heartfelt condolences go out to her children, Lisa and Scott, her granddaughter, Brynn, and her sister, Nayda, and the entire family.

Magda Kegley, a longtime employee of Children Incorporated, passed away quite suddenly on Saturday, March 8th, 2025. During her tenure with Children Incorporated, Magda served in various capacities, including over two decades as Director of our International Division. Many of our coordinators and sponsors became quite familiar with Magda and grew to love her, just as our staff did. She was a ray of sunshine, always smiling and always caring about others. Magda’s kind words touched many hearts, and her laughter challenged us all to find joy in life. Our staff will certainly miss our dear friend. Our heartfelt condolences go out to her children, Lisa and Scott, her granddaughter, Brynn, and her sister, Nayda, and the entire family. Hogar Casa Julia in San Miguel de Allende”.

Hogar Casa Julia in San Miguel de Allende”.